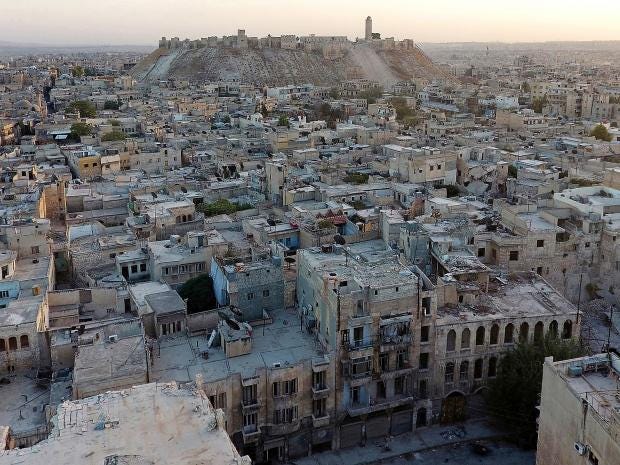

Exclusive: Speaking for the first time as the bombardment of Aleppo continues, General Jamil Hassan – a man facing sanctions from both the US and EU – says he's ‘astounded the US and UN make all this effort for this very small district’

Click to follow

The Independent Online

The Independent Online

It’s not every day that you come face to face with the commander of the most powerful, ruthless – and undoubtedly most feared – security agency in all of Syria. The very words “Syrian Air Force Intelligence” are enough to stop any conversation in its tracks. The “moderate” Free Syrian Army famously reported the assassination of this most loyal and ferocious of presidential protectors four years ago and even Wikipedia still refers to him in the past tense. But I can assure you that 63-year old General Jamil Hassan is very much alive.

His handshake is vice-like, and his eyes – which stare at you like an angry interrogator when he speaks – fixed their gaze upon me like a lighthouse beam when I asked him if he was a cruel man. His voice combines a lion’s roar with the slow deliberation of an intelligence boss who is fast running out of patience.

This is not a man to be crossed. “In the Western media, I am a war criminal,” he growls at me. “So I’m not sure your article about me will be allowed in The Independent. I am ready – even if they take me to the War Crimes Tribunal – to continue with my work. Because Syria deserves the sacrifice.”

General Hassan is slightly exaggerating his notoriety. No war crimes court has sought his arrest. But the EU has condemned him for his “involvement in the repression against the civilian uprising” in Syria in 2011, imposing both a travel ban and a freezing of his financial assets.

The US Treasury, after threats by President Barack Obama against the Syrian regime, has imposed its own sanctions upon the general “for engaging in the commission of human rights abuses.” The Americans stated that Syrian Air Force Intelligence – whose name derives from President Bashar al-Assad’s father Hafez, who was a Syrian air force officer – killed at least 43 demonstrators in April 2011. Of which, more later.

Throughout our astonishing three-hour interview, General Jamil Hassan ducked no questions, even about his own prisons, and while repeatedly declaring his loyalty to President Bashar al-Assad, made it perfectly clear that a more ruthless reaction to the first hints of revolution in Syria in 2011 might have crushed all armed opposition to the regime at once.

He even referred to the crushing of the Muslim Brotherhood revolt in Hama in 1982, when thousands of civilians and fighters were slaughtered after the Brotherhood went on a murderous rampage against Ba‘ath Party members in the city.

General Hassan was a junior security officer at the time, serving Hafez el-Assad’s government. “I was a very young man,” he said. “There were exaggerated media reports [of the casualties]. [But] if we did what we did in Hama at the beginning of this crisis, we would have saved a lot of Syrian blood.” I was also briefly in Hama during the 1982 revolt: I recorded at the time that fatalities might have reached 20,000.

It was a strange, unexpected – and unsought – meeting with one of Syria’s most powerful figures. Outside the general’s office hung one Syrian and three Russian flags. He knew his history books, and he lit a Churchill cigar as he spoke of Hitler, Rommel, Montgomery and Churchill. But there was no doubt in his mind as to just who was to blame for Syria’s tragedy.

Boy asks if he will die after alleged chlorine attack in Aleppo

“The West conspires against Syria,” he almost shouts at me. “First Israel, the head of the snake and all who support its policies, along with the Arab regimes, led by Saudi Arabia – I’m not talking about the Saudis as a people, but the King and the royal family – this selfish and narcissistic family which has a very dirty attitude towards the Arab people, especially a country like Syria, which has a disciplined [sic] rule and a young leader…who is very intelligent and knows the interests of his people and even the interests of the whole Arab world.

The Israelis and the dirty rulers of Arab peoples are not interested in these attitudes. They need agents to execute their own agendas…need to execute their agendas – because they know that the strength of Syria is in its unity. So they do all this to divide Syria. They encourage extremist ideology. The big role in this was that of the Wahabis and al-Qaeda and their black doctrines. From this, they launched their plans to divide Syria.”

I restrained myself from telling General Hassan that the last time I heard such condemnation of the Saudi autocracy, it came from the mouth of Osama bin Laden, talking to me in Afghanistan of his wish to destroy the Saudi regime.

The Independent

His handshake is vice-like, and his eyes – which stare at you like an angry interrogator when he speaks – fixed their gaze upon me like a lighthouse beam when I asked him if he was a cruel man. His voice combines a lion’s roar with the slow deliberation of an intelligence boss who is fast running out of patience.

This is not a man to be crossed. “In the Western media, I am a war criminal,” he growls at me. “So I’m not sure your article about me will be allowed in The Independent. I am ready – even if they take me to the War Crimes Tribunal – to continue with my work. Because Syria deserves the sacrifice.”

General Hassan is slightly exaggerating his notoriety. No war crimes court has sought his arrest. But the EU has condemned him for his “involvement in the repression against the civilian uprising” in Syria in 2011, imposing both a travel ban and a freezing of his financial assets.

The US Treasury, after threats by President Barack Obama against the Syrian regime, has imposed its own sanctions upon the general “for engaging in the commission of human rights abuses.” The Americans stated that Syrian Air Force Intelligence – whose name derives from President Bashar al-Assad’s father Hafez, who was a Syrian air force officer – killed at least 43 demonstrators in April 2011. Of which, more later.

Throughout our astonishing three-hour interview, General Jamil Hassan ducked no questions, even about his own prisons, and while repeatedly declaring his loyalty to President Bashar al-Assad, made it perfectly clear that a more ruthless reaction to the first hints of revolution in Syria in 2011 might have crushed all armed opposition to the regime at once.

He even referred to the crushing of the Muslim Brotherhood revolt in Hama in 1982, when thousands of civilians and fighters were slaughtered after the Brotherhood went on a murderous rampage against Ba‘ath Party members in the city.

General Hassan was a junior security officer at the time, serving Hafez el-Assad’s government. “I was a very young man,” he said. “There were exaggerated media reports [of the casualties]. [But] if we did what we did in Hama at the beginning of this crisis, we would have saved a lot of Syrian blood.” I was also briefly in Hama during the 1982 revolt: I recorded at the time that fatalities might have reached 20,000.

It was a strange, unexpected – and unsought – meeting with one of Syria’s most powerful figures. Outside the general’s office hung one Syrian and three Russian flags. He knew his history books, and he lit a Churchill cigar as he spoke of Hitler, Rommel, Montgomery and Churchill. But there was no doubt in his mind as to just who was to blame for Syria’s tragedy.

Boy asks if he will die after alleged chlorine attack in Aleppo

“The West conspires against Syria,” he almost shouts at me. “First Israel, the head of the snake and all who support its policies, along with the Arab regimes, led by Saudi Arabia – I’m not talking about the Saudis as a people, but the King and the royal family – this selfish and narcissistic family which has a very dirty attitude towards the Arab people, especially a country like Syria, which has a disciplined [sic] rule and a young leader…who is very intelligent and knows the interests of his people and even the interests of the whole Arab world.

The Israelis and the dirty rulers of Arab peoples are not interested in these attitudes. They need agents to execute their own agendas…need to execute their agendas – because they know that the strength of Syria is in its unity. So they do all this to divide Syria. They encourage extremist ideology. The big role in this was that of the Wahabis and al-Qaeda and their black doctrines. From this, they launched their plans to divide Syria.”

I restrained myself from telling General Hassan that the last time I heard such condemnation of the Saudi autocracy, it came from the mouth of Osama bin Laden, talking to me in Afghanistan of his wish to destroy the Saudi regime.

The Independent