Student loan debt has now reached $1 billion, and the situation has gotten so bad that there are Americans who are having their Social Security checks garnished to pay off outstanding loan debt. Meanwhile, recent graduates sit in a precarious position of underemployment, combined with doubling rates and rising monthly bills as their loans are sold from one lender to another. It’s clear that we’ve reached a crisis point. But what got us here?

There are several places where we can lay blame: colleges, for becoming so expensive and ignorant of student finance, the government, for restrictive policies and inflating prices with student aid, private lenders with predatory tactics, and even students for allowing themselves to get in too deep. The fault lies not with just one, but all of these student loan villains, who have all done their part to bring us to a very real point of trouble. Read on to learn in detail how each of these groups has played a role in the destruction of student loans.

-

Colleges

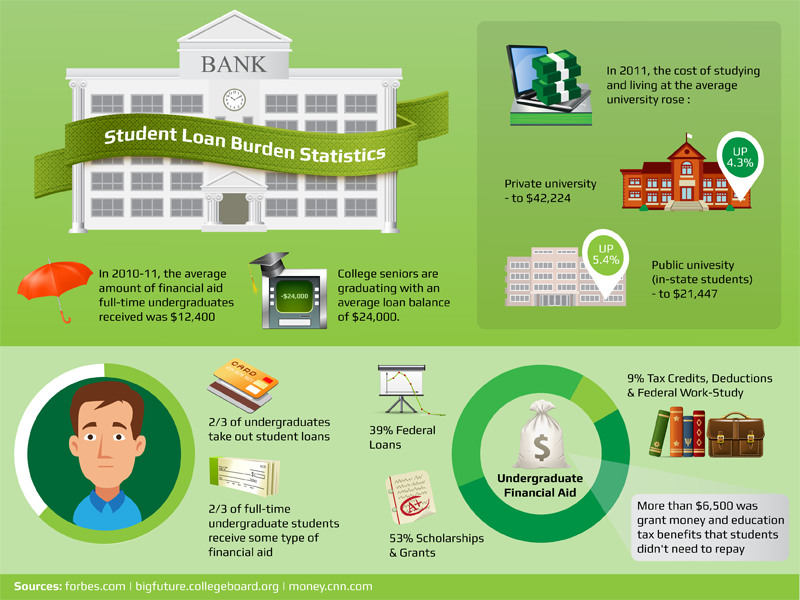

Although students, Congress, and banks are catching a lot of flack for the student loan crisis, many are pointing out that the high cost of college that creates the need for so many mind-blowing loan bills is the real problem. Cato Institute research shows it costs just $8,000 a year to educate an undergrad at the average residential college, while most students pay double that: $16,000 at public universities and $37,000 at private ones. What’s making up this major discrepancy? Multimillion dollar sports programs, glowing recreational facilities, excessive administration, and tenured faculty who may or may not actually be teaching are the most likely culprits. It seems that colleges can raise their prices because they know they’ll get paid one way or another, whether it’s through grants, scholarships, loans, government contributions, or endowments. Colleges raise tuition, get more aid, and raise tuition again in a vicious cycle that is not at all beneficial to students. -

Financial aid offices

Whether the heart of the problem lies with price of education or not, it seems that colleges aren’t doing a whole lot to make student loans a responsible process. Financial aid offices aren’t known as places that will gently point out to students that perhaps they’ve gotten in over their heads, even though they often have a full picture of just how bad a student’s financial situation has become. Financial aid offices are in a great place to assess the financial situations of students and give them a reality check before they get in too deep. But it sure doesn’t seem like colleges want to do that. Some, like NYU’s VP of Enrollment Randall Deike, believe that it would be “completely inappropriate” for universities to take on such a role, as “some families will do whatever it takes for their son or daughter to be not just at N.Y.U., but any first-choice college.” Others may be hesitant to point out the problem, as it will likely send students to a different, cheaper college and push down enrollment numbers. U.S. Senators Dick Durbin and Tom Harkin are working on a solution to this problem, introducing a bill to require that colleges offer counseling to students who are seeking private student loans. -

The federal government

Government intervention into student finance has been well-intentioned, but produced disastrous results. US News and World Report points out that the federal goals of making a college education within reach, while requiring that debts ultimately be repaid certainly seem reasonable and noble, but have not exactly worked out as planned. Where there was once a $2,500 annual limit on federal student loans, there’s now a $31,000 limit for four years. As the federal government pumps out more financial aid to help students afford college, colleges find that they can charge more for tuition, making education less affordable. And just about everyone can take out a student loan, giving colleges no incentive to keep costs down while students continue to rack up five-figure loan bills just to get a four-year degree. Even if students declare bankruptcy in the future their student loan debt lives on, as the government has deemed that student loans are not dischargeable. Beginning in 2014, student loan forgiveness laws will go into effect, capping federal loan payments at 10% of a student’s income, and forgiven after 15 years. This is excellent news for the future, but it doesn’t do a whole lot to help out those who are struggling today. Loans can be deferred, but ultimately, they must be paid. -

Lenders

The government isn’t the only one handing out student loans like candy. Once students reach the limit on what they can borrow through federal student loans, they can turn to private lenders with much less favorable terms, but the same non-dischargeable debt. This fills the gap between what the government will provide, and what students need to actually pay for school, but it’s a dangerous situation to be in.nStudents with private loans are often subject to having their loans sold and terms changed, which can alter their loan payments by hundreds of dollars per month. These loans are convenient for students who need them to get through school, but their existence is highly problematic. Lenders like Sallie Mae and Wells Fargo have been accused of making subprime loans to student borrowers, not taking into consideration the risks behind these loans. They’ve given money to students attending schools with low graduation rates, students who may or may not actually finish school, get a job, and have the means to pay back their student loan. What happens then? They just sell off the debt, or, get a government bailout to cover the losses. The five biggest private student loan lenders have made profits reaching well into the billions, but at the same time, were able to get a $112 billion bailout from the government for loans that could no longer be sold. -

Students and their families

We hate to blame the victims, but we have to ask: what exactly did students think they were getting into? Why didn’t parents save? Many programs exist. Obviously, many students feel that they don’t have a choice, and student loans, even subprime ones, often mean the difference between getting a college degree and not going to school at all (or worse, dropping out halfway). With big plans to get a great job after graduation, we’re sure that most students feel confident that they’ll be able to pay their student loan bills off without a whole lot of trouble. But why aren’t students more wary of taking on so much debt, especially with poor job prospects? We have to point out that there are often situations in which students could have acted more responsibly, and must bear some of the blame for our unfortunate student loan situation. It is possible to graduate college without debt, even if your parents haven’t saved one red cent. Enrolling at an in-state public college, starting out in community college, hunting down scholarships, picking up part-time work and paid internships, and even living at home are all major ways that students can make their school bills more manageable. Would we be in this situation if more students availed themselves of these options rather than taking a blind leap of faith right into crushing debt?

Taken From Online Colleges

No comments:

Post a Comment